UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

Tejon Ranch Co.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i) | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Post Office Box 1000

Tejon Ranch, California 93243

March 30, 20152016

Dear Stockholder:

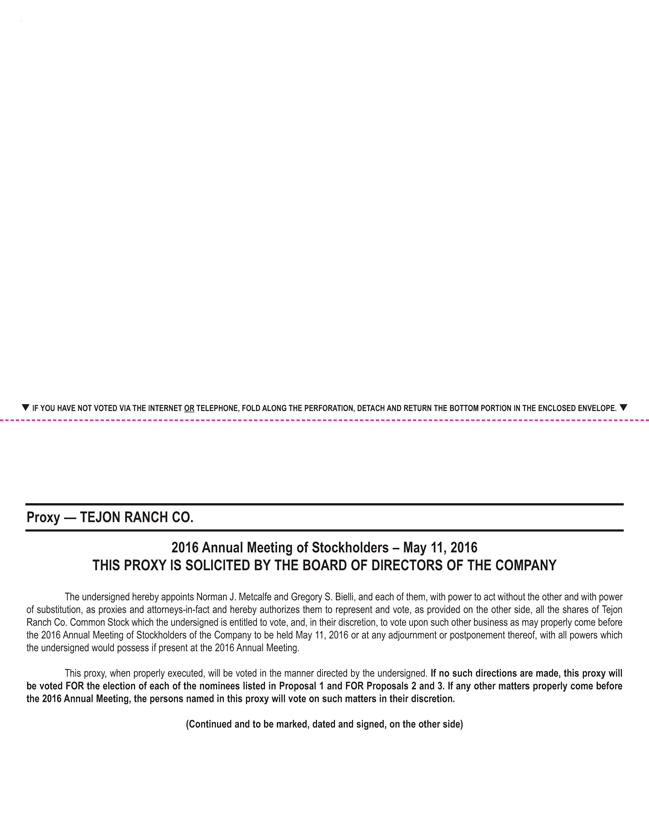

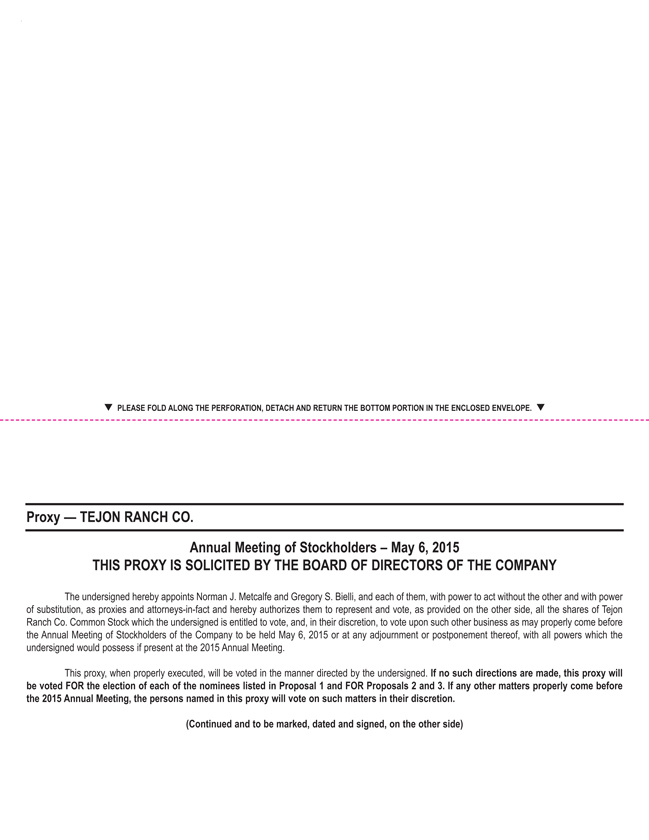

You are cordially invited to attend the Annual Meeting of Stockholders of Tejon Ranch Co. (“Company”(the “Company”) on Wednesday, May 6, 2015,11, 2016, at 9:30 A.M., Pacific Time, at the Balboa Bay Resort, 1221 West Coast Highway, Newport Beach, California, 92663. Your Board of Directors and management look forward to greeting those stockholders who are able to attend. If you are planning to attend the meeting in person you will need to present proof that you own shares of the Company.Company, such as a government-issued photo identification and a proxy card or voting instruction form with your name on it.

The Notice of Annual Meeting and Proxy Statement, which contain information concerning the business to be transacted at the meeting, appear in the following pages.

It is important that your shares be represented and voted at the meeting, whether or not you plan to attend. Please vote on the enclosed proxy at your earliest convenience.

Your interest and participation in the affairs of the Company are greatly appreciated.

Sincerely,

Gregory S. Bielli,

President and Chief Executive Officer

| Sincerely, |

| Gregory S. Bielli, |

| President and Chief Executive Officer |

TEJON RANCH CO.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

on

May 6, 201511, 2016

The Annual Meeting of Stockholders of Tejon Ranch Co. (the “Company” or “Tejon” or referred to as “we”, “us”, “our” or words of similar import in this Proxy Statement) will be held at the Balboa Bay Resort, 1221 West Coast Highway, Newport Beach, California, 92663 on Wednesday, May 6, 2015,11, 2016, at 9:30 A.M., Pacific Time, for the following purposes:

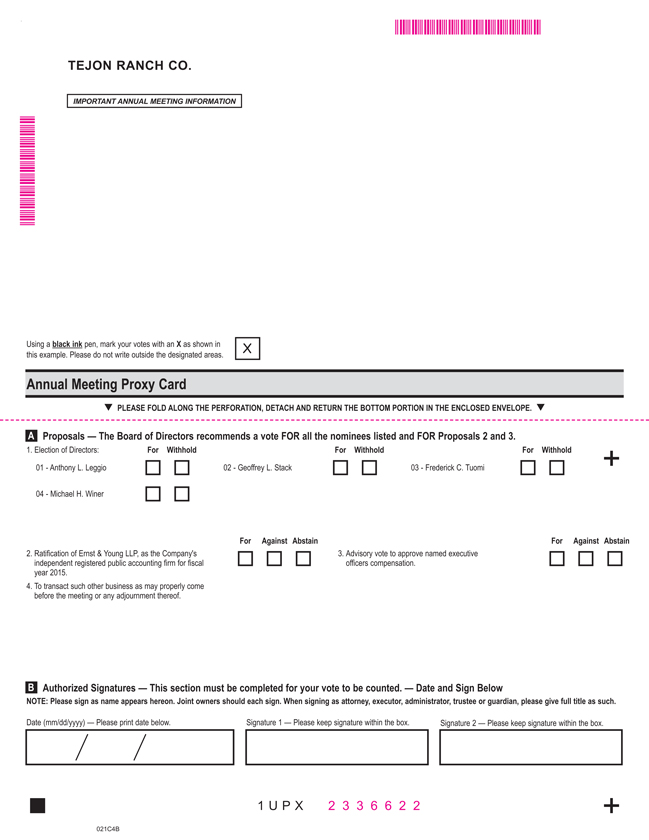

| 1. | To elect the |

| 2. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year |

| 3. | To seek an advisory vote to approve named executive |

| 4. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

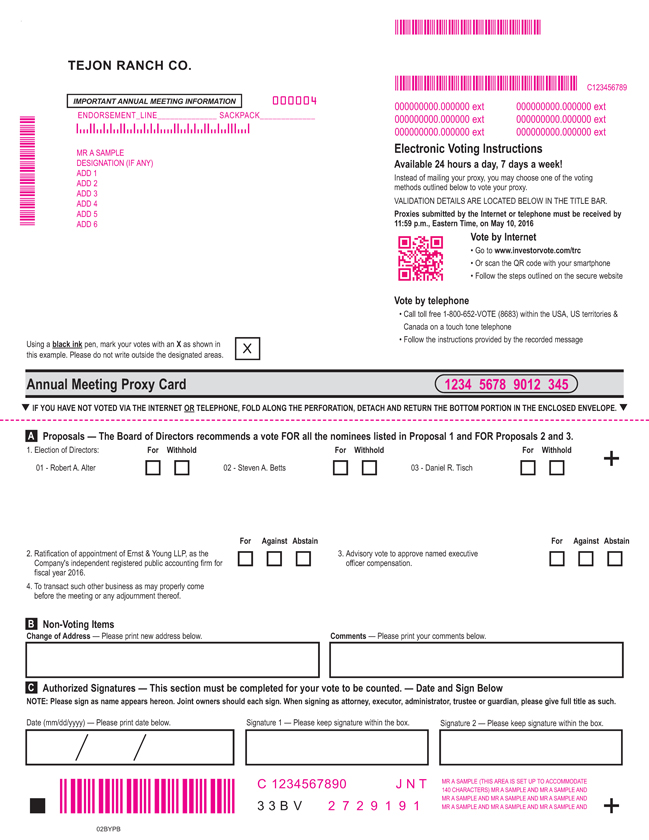

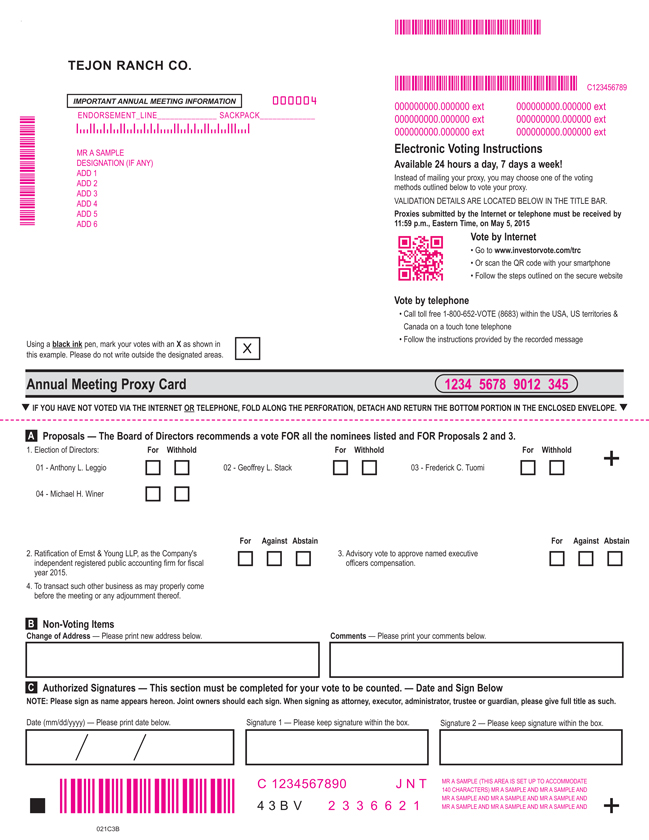

The nominees of the Board of Directors of the Company for election at the meeting are Anthony L. Leggio, Geoffrey L. Stack, Frederick C. Tuomi,Robert A. Alter, Steven A. Betts, and Michael H. Winer.Daniel R. Tisch.

The Board of Directors of the Company recommends that you vote “FOR” the election of each of the nominees and “FOR” the approval of each of the other proposals outlined in the Proxy Statement accompanying this notice.

The Board of Directors has fixed the close of business on March 11, 2015,14, 2016, as the record date for the determination of stockholders entitled to notice of and to vote at the meeting.

Your attention is inviteddirected to the accompanying Proxy Statement. To ensure that your shares are represented at the meeting, please date, sign, and mail the enclosed proxy card, for which a return envelope is provided, or vote your proxy by phone or the internet, the instructions for which are provided on the enclosed proxy card.

Please note that if your shares are held by a broker, bank or other holder of record, your broker, bank or other holder of record will NOT be able to vote your shares with respect to Proposal 1 or Proposal 3 unless you provide them with directions on how to vote. We strongly encourage you to return the voting instruction form provided by your broker, bank or other holder of record or utilize your broker’s telephone or internet voting if available and exercise your right to vote as a stockholder.

For the Board of Directors,

| For the Board of Directors, |

NORMAN J. METCALFE, Chairman of the Board |

ALLEN E. LYDA, Chief Financial Officer, Assistant Secretary |

Tejon Ranch, California

March 30, 20152016

PLEASE MARK YOUR INSTRUCTIONS ON THE ENCLOSED PROXY, SIGN AND DATE THE PROXY, AND RETURN IT IN THE ENCLOSED POSTAGE PAID ENVELOPE. ALTERNATIVELY, PLEASE VOTE YOUR PROXY BY PHONE OR THE INTERNET. PLEASE VOTE YOUR PROXY EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING. IF YOU ATTEND THE MEETING AND WISH TO DO SO, YOU MAY VOTE YOUR SHARES IN PERSON EVEN IF YOU HAVE PREVIOUSLY SUBMITTED YOUR PROXY.

| 2016 | Notice of Annual Meeting of Stockholders and Proxy Statement |

Table of Contents of the Proxy Statement

TEJON RANCH CO.

Post Office Box 1000

Tejon Ranch, California 93243

PROXY STATEMENT

Annual Meeting of Stockholders

May 6, 201511, 2016

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders To Be Held on May 6, 201511, 2016

The Proxy Statement and accompanying Annual Report to Stockholders are available at www.tejonranch.com or at http://www.materials.proxyvote.com/879080

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Company for use at the Annual Meeting of Stockholders to be held on May 6, 201511, 2016 (the “2015“2016 Annual Meeting”).

It is anticipated that the mailing of this Proxy Statement and accompanying form of Proxy to stockholders will begin on or about March 31, 2015.2016.

At the meeting, the stockholders of the Company will be asked to vote on the following matters: (1) the election of the fourthree directors named in this Proxy Statement, (2) the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2015,2016, (3) an advisory vote to approve executive compensation, and (4) such other business as may properly come before the meeting. The Company’s Board of Directors (the “Board”) is asking for your proxy for use at the 20152016 Annual Meeting. Although management does not know of any other matter to be acted upon at the meeting, shares represented by valid proxies will be voted by the persons named on the proxy in accordance with their best judgment with respect to any other matters which may properly come before the meeting.

The costs for this proxy solicitation will be paid by the Company. Following the mailing of this Proxy Statement, directors, officers, and regular employees of the Company may solicit proxies by mail, telephone,e-mail, or in person; such persons will receive no additional compensation for such services. Brokerage houses and other nominees, fiduciaries and custodians nominally holding shares of record will be requested to forward proxy soliciting material to the beneficial owners of such shares and will be reimbursed by the Company for their charges and expenses in connection therewith at the rates approved by the New York Stock Exchange.

General Information

Holders of shares of the Company’s Common Stock, par value $0.50 (the “Common Stock”) of record at the close of business on March 11, 201514, 2016 (the “Record Date”) are entitled to notice of, and to vote at, the meeting. There were 20,645,54720,703,838 shares of Common Stock outstanding on the Record Date. Each stockholder is entitled to one vote for each share of Common Stock held as of the Record Date on all matters presented at the 2015 Annual Meeting other than the election of directors. A stockholder of record giving a proxy may revoke it at any time before it is voted by filing with the Company’s Secretary a written notice of revocation or by submitting a later-dated proxy via the Internet, by telephone, or by mail. Unless a proxy is revoked, shares represented by a proxy will be voted in accordance with the voting instructions on the proxy and, on matters for which no voting instructions are given, shares will be voted “for” the nominees of the Board and “for” Proposals 2 and 3. If you hold shares in a stock brokerage account or by a bank or other holder of record, you must follow the instructions of your broker, bank or other holder of record to change or revoke your voting instructions.

1

Broker Non-Votes

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered to be the “beneficial owner” of those shares. As the beneficial owner, you have the right to instruct your broker, bank or other holder of record how to vote your shares. If you do not provide instructions, your broker, bank or other holder of record will not have the discretion to vote with respect to certain matters and your shares will constitute “broker non-votes” with respect to those matters. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Specifically, your broker, bank or other holder of record will not have the discretion to vote with respect to Proposal 1 and Proposal 3, but will have discretion to vote on Proposal 2. Therefore, we strongly encourage you to follow the voting instructions on the materials you receive.

Quorum

The holders of record of a majority of the Common Stock entitled to vote at the 20152016 Annual Meeting must be present at the 20152016 Annual Meeting, either in person or by proxy, in order for there to be a quorum at the 20152016 Annual Meeting. Shares of Common Stock with respect to which the holders are present in person at the 20152016 Annual Meeting but not voting, and shares of Common Stock for which we have received proxies but with respect to which the holders of the shares have abstained, will be counted as present at the 20152016 Annual Meeting for the purpose of determining whether or not a quorum exists. Broker non-votes will also be counted as present for the purpose of determining whether a quorum exists. Stockholders cannot abstain in the election of directors, but they can withhold authority. Stockholders who withhold authority will be considered present for purposes of determining a quorum.

Voting Requirements

For Proposal 1 (election of directors), the four (4)three (3) candidates receiving the highest number of affirmative votes at the 20152016 Annual Meeting (also referred to as a plurality) will be elected as directors. Stockholders will be able to cumulate their vote in the election of directors. Cumulative voting means that each stockholder is entitled to a number of votes equal to the number of directors to be elected multiplied by the number of shares he or she holds. These votes may be cast for one nominee or distributed among two or more nominees. To exercise the right to cumulate votes, a stockholder must provide written instructions on the proxy card how the stockholder wishes to have his or her votes distributed. AbstentionsWithhold votes and broker non-votes will not be counted as participating in the voting, and will therefore have no effect for purposes of Proposal 1.

Approval of Proposal 2 (the ratification of Ernst & Young LLP as our independent registered public accounting firm) will require the affirmative vote of the holders of a majority of the shares of Common Stock present in person or represented by proxy and entitled to vote at the 20152016 Annual Meeting. Abstentions will be counted as present and will thus have the effect of a vote against Proposal 2.

Approval of Proposal 3 (advisory approval vote on executive compensation) will require the affirmative vote of the holders of a majority of the shares of Common Stock present in person or represented by proxy and entitled to vote at the 20152016 Annual Meeting. Abstentions will be counted as present and will thus have the effect of a vote against Proposal 3. Broker non-votes will not be counted as participating in the voting and will therefore have no effect on the outcome of the vote.

Pursuant to Delaware corporate law, the actions contemplated to be taken at the 20152016 Annual Meeting do not create appraisal or dissenters rights.

2015 Performance Highlights

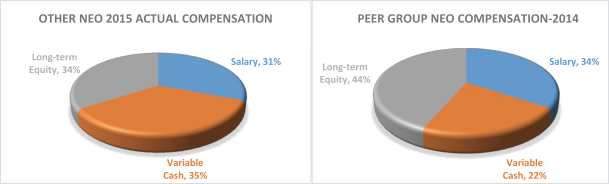

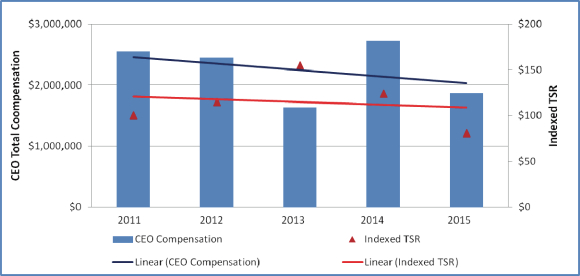

2In determining 2015 compensation for our named executive officers, (NEOs), the Compensation Committee of the Board of Directors considered the contributions of each of our executive officers to the Company’s strategy related to revenue, cash management, continued expansion of Tejon Ranch Commerce Center, and moving our residential development projects through the mapping and entitlement process. The Compensation Committee considered these items with a particular emphasis on the following areas:

• Total Company revenue including other income and equity in earnings of joint ventures was $58,380,000 in 2015 as compared to $57,585,000 in 2014. The growth in revenue is driven by increases in commercial/industrial revenue and equity in earnings of joint ventures. |

| |||||||

| 2015 | 2014 | |||||||

Total operating revenues | 51,147,000 | 51,069,000 | ||||||

Total other income | 909,000 | 1,222,000 | ||||||

Equity in earnings of unconsolidated joint ventures | 6,324,000 | 5,294,000 | ||||||

|

|

|

| |||||

| 58,380,000 | 57,585,000 | |||||||

• Net cash provided by operating activities of $16,968,000 during 2015 as compared to $13,218,000 in 2014. This improvement as compared to the prior year is primarily related to distributions from unconsolidated joint ventures. |

| |||||||

• Approval of business plan for Mountain Village at Tejon Ranch and beginning of the tentative tract map process. |

| |||||||

• Approval of Antelope Valley Area Plan providing land us designations and zoning for Centennial at Tejon Ranch. |

| |||||||

• Authorization to move forward with construction of new 250,000 square-foot industrial building at Tejon Ranch Commerce Center and completion and delivery of second multi-tenant retail building in December 2015. |

| |||||||

Our Compensation Discussion and Analysis is on pages 18 to 39 and our Summary Compensation Table and other compensation tables are on pages 39 to 47.

THE ELECTION OF DIRECTORS

The Board currently consists of eleventen directors divided into three classes based upon when their terms expire. The terms of four directors (Class I) will expire at the 2015 Annual Meeting, the terms of threetwo current directors (Class II) will expire at the 2016 Annual Meeting, and the terms of four current directors (Class III) will expire at the 2017 Annual Meeting, and the terms of four directors (Class I) will expire at the 2018 Annual Meeting. The regular term of each director expires at the third Annual Meeting following the Annual Meeting at which that director was elected, so that each director serves a three-year term, although directors continue to serve until their successors are elected and qualified, unless the authorized number of directors has been decreased.

The nominees of the Board for election at the 20152016 Annual Meeting to serve as Class III directors are Anthony L. Leggio, Geoffrey L. Stack, Frederick C. Tuomi,Robert A. Alter, Steven A. Betts and Michael H. Winer,Daniel R. Tisch, all of whom are presently directors. Mr. Tisch was last elected by the stockholders at the 2013 Annual Meeting and Messrs. Alter and Betts were originally recommended by a third-party search firm, approved by the non-management directors then serving on the Nominating and Corporate Governance Committee and elected by the Board of Directors in September 2014. Messrs. Alter and Tisch currently serve as Class II Directors and Mr. Betts currently serves as a Class III Director. In order to cause the three classes of directors to be as nearly equal in number of directors as possible, the Board wishes to change Mr. Betts from a Class III Director to a Class II Director. To facilitate this change, the Board is nominating for election as a Class II Director at the 2016 Annual Meeting Mr. Betts, who has agreed to resign from Class III if he is elected as a Class II Director. If Mr. Betts is elected, he will resign as a Class III director, effective upon his taking office as a Class II Director. If Mr. Betts is not elected, he will remain in office until his term as a Class III Director expires at the 2017 Annual Meeting or his earlier death, resignation or removal.

Nominations of persons for election to the Board by stockholders must be made pursuant to timely notice in writing to the Secretary of the Company pursuant to the Company’s Certificate of Incorporation. See “Stockholder Proposals for 20162017 Annual Meeting” for additional information on the procedure for stockholder nominations.

Except as noted below, each proxy solicited by and on behalf of the Board will be voted “FOR” the election of the nominees named above (unless such authority is withheld as provided in the proxy), and unless otherwise instructed, one-quarterone-third of the votes to which the stockholder is entitled will be cast for each of the nominees. All of the nominees of the Board have consented to being named in this proxy statement and to serve if elected. In the event any one or more of the nominees shall become unable to serve or for good cause refuse to serve as director (an event which is not anticipated), the proxy holders will vote for substitute nominees in their discretion. If one or more persons other than those named below as nominees for the 20152016 Annual Meeting are nominated as candidates for director by persons other than the Board, the enclosed proxy may be voted in favor of any one or more of said nominees of the Board and in such order of preference as the proxy holders may determine in their discretion.

Brokers do not have discretion to vote on this proposal without your instruction. Therefore, if you are a beneficial owner and you do not instruct your broker how to vote on this proposal, your shares will not be voted on this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES NAMED ABOVE FOR ELECTION AS A DIRECTOR.

3

THE RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015.2016. Services provided to the Company and its subsidiaries by Ernst & Young LLP in fiscal years 20142015 and 20132014 are described under “Audit Fees” below. Additional information regarding the Audit Committee is provided in the Report of the Audit Committee below.

Representatives of Ernst & Young LLP are expected to be present at the 20152016 Annual Meeting and will have an opportunity to make a statement if they wish and will be available to respond to appropriate questions from stockholders.

Stockholder Ratification of the Appointment of Independent Registered Public Accountant.Accounting Firm.

We are asking our stockholders to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm. Although ratification is not required by our certificate of incorporation, bylaws or otherwise, the Board is submitting the selection of Ernst & Young LLP to our stockholders for ratification as a matter of good corporate practice. In the event stockholders do not ratify the appointment of Ernst & Young LLP, the appointment may be reconsidered by the Audit Committee and the Board. Even if the selection is ratified, the Audit Committee may, in its discretion, select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.

Independent Registered Public Accounting Firm

Ernst & Young LLP served as the Company’s independent registered public accounting firm for the year ended December 31, 20142015 and was selected by the Audit Committee to serve in that capacity for the fiscal year 20152016

Audit Fees. The aggregate fees billed by Ernst & Young LLP for professional services rendered for the audit of the Company’s annual financial statements for the year ended December 31, 2015 and for the reviews of the financial statements included in the Company’s Forms 10-Q for the year ended December 31, 2015 were $524,438. The aggregate fees billed by Ernst & Young LLP for professional services rendered for the audit of the Company’s annual financial statements for the year ended December 31, 2014 and for the reviews of the financial statements included in the Company’s Forms 10-Q for the year ended December 31, 2014 were $504,429. The aggregate fees billed by Ernst & Young LLP for professional services rendered for the audit of the Company’s annual financial statements for the year ended December 31, 2013 and for the reviews of the financial statements included in the Company’s Forms 10-Q for the year ended December 31, 2013 were $517,334.

Audit-Related Fees. The aggregate fees billed for assurance and related services by Ernst & Young LLP that were reasonably related to the performance of the audit or review of the Company’s financial statements, including fees for the performance of audits and attest services not required by statute or regulations; audits of the Company’s employee benefit plans; due diligence activities related to investments; and accounting consultations about the application of generally accepted accounting principles to proposed transactions (collectively, the “Audit-Related Fees”), for the year ended December 31, 20142015 were $2,000. The Audit-Related Fees billed by Ernst & Young LLP for the year ended December 31, 20132014 were $12,360.$2,000.

Tax Fees. The aggregate fees billed by Ernst & Young LLP for tax compliance, advice and planning services for the year ended December 31, 20142015 were $101,070.$134,698. The aggregate fees billed by Ernst & Young LLP for tax compliance, advice and planning services for the year ended December 31, 20132014 were $85,544.$101,070. All fees billed for both 20142015 and 20132014 were solely related to compliance and planning services for tax return preparation.

4

All Other Fees. Ernst & Young LLP did not bill for any services other than those listed above for the years ended December 31, 20142015 or December 31, 2013.2014.

The Audit Committee Charter requires that the Audit Committee pre-approve all services performed by the Company’s outside auditor. To fulfill this requirement, Ernst & Young LLP provides a proposal to the Audit Committee for all services it proposes to provide, and the Audit Committee then takes such action on the proposal, as it deems advisable. During the years ending December 31, 20142015 and 2013,2014, 100% of the services provided by Ernst & Young LLP were pre-approved by the Audit Committee.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2015.2016.

5

ADVISORY APPROVAL VOTE ON EXECUTIVE COMPENSATION

In accordance with Section 14A of the Securities Exchange Act of 1934, or the Exchange Act, we are asking stockholders to approve on an advisory basis the compensation paid to the Company’s named executive officers, as disclosed in this proxy statement on pages 1618 to 42.47.

The Board of Directors recommends athat shareholders vote FOR this proposal because it believes that ourto approve, on an advisory basis, the compensation policies and practices are effective in achievingpaid to the Company’s goals of rewarding financial and operating performance, aligning the executives’ long-term interests with those of our stockholders and motivating the executives to remain with the Company.

Our executive compensation programs have a number of features designed to promote these objectives. In determining 2014 compensation for our named executive officers or NEOs, the Compensation Committee evaluated the successas described in meeting defined cash and segment profit goals as well as the achievement of short-term goals that set the stagethis Proxy Statement , for the achievementfollowing reasons.

Sound program design

We design our executive officers compensation programs to attract, motivate, and retain the key executives who drive our success and industry leadership while considering individual and Company performance and alignment with the interest of performance milestone goals.long-term shareholders. We achieve our objectives through compensation that:

ü provides a competitive total pay opportunity, |

ü consists primarily of performance based compensation, |

ü enhances retention through multi-year vesting of stock awards, and |

ü does not encourage unnecessary and excessive risk taking. |

Best practices in executive compensation

Some of our leading practices include:

ü an executive compensation recovery policy, |

ü an executive stock ownership policy, |

ü a policy prohibiting pledging and hedging ownership of Tejon stock, |

ü no executive-only perquisites or benefits, |

ü no guaranteed bonus programs, and |

ü utilization of an independent compensation consultant who reports to the Compensation Committee. |

The advisory proposal, commonly referred to as a “say-on-pay” proposal, is not binding on the Board of Directors. Although the voting results are not binding, the Board will review and consider them when evaluating our executive compensation program.

The Board’s policy going forward is to hold an advisory vote on executive compensation every year, and accordingly, we expect that, after the 20152016 Annual Meeting, the next advisory vote on the compensation of our named executive officers will take place at our 20162017 Annual Meeting.

Brokers do not have discretion to vote on this proposal without your instruction. Therefore, if you are a beneficial owner and you do not instruct your broker how to vote on this proposal, your shares will not be voted on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS AS DISCLOSED ON PAGES 1618 TO 4247 IN THE PROXY STATEMENT.

6

Consideration of Director Nominees

The Board believes the Board, as a whole, should possess the requisite combination of skills, professional experience, and diversity of backgrounds to oversee the Company’s business. The Board also believes that there are certain attributes each individual director should possess, as discussed below. Accordingly, the Board and the Nominating and Corporate Governance Committee (the “Nominating Committee”) consider the qualifications of directors and director candidates individually as well as in the broader context of the Board’s overall composition and the Company’s current and future needs.

The Nominating Committee is responsible for selecting nominees for election to the Board. In considering candidates for the Board, the Nominating Committee evaluates the entirety of each candidate’s credentials, attributes, and other factors (as described in greater detail in the Company’s Corporate Governance Guidelines), but does not have any specific minimum qualifications that must be met by a nominee. However, the Nominating Committee seeks as directors individuals with substantial management experience who possess the highest personal values, judgment and integrity, an understanding of the environment in which the Company does business and diverse experience with the key business, financial and other challenges that the Company faces. In addition, in considering the nomination of existing directors, the Nominating Committee takes into consideration (i) each director’s contribution to the Board; (ii) any material change in the director’s employment or responsibilities with any other organization; (iii) the director’s ability to attend meetings and fully participate in the activities of the Board and the committees of the Board on which the director serves; (iv) whether the director has developed any relationships with the Company or another organization, or other circumstances that may have arisen, that might make it inappropriate for the director to continue serving on the Board; and (v) the director’s age and length of service on the Board.

Because the Nominating Committee recognizes that a diversity of viewpoints and practical experiences can enhance the effectiveness of the Board, as part of its evaluation of each candidate, the Nominating Committee takes into account how each candidate’s background, experience, qualifications, attributes and skills may complement, supplement or duplicate those of other prospective candidates. The Nominating Committee reviews its effectiveness in balancing these considerations when assessing the composition of the Board, which as discussed below is one of the committee’s responsibilities.

Based on the parameters described above, the Board has determined that the directors standing for reelection and the remaining members of the Board have the qualifications, experience, and attributes appropriate for a director of the Company. As reflected below, each director has a varied background in the real estate industry, finance, and/or agriculture. These are all areas that are integral to the strategy, operations and successful oversight of the Company.

Board Composition and Leadership Structure

The Board is grouped into three classes: (1) Class I Directors, whose terms will expire at the 20152018 Annual Meeting, (2) Class II Directors, whose terms will expire at the 2016 Annual Meeting, and (3) Class III Directors, whose terms will expire at the 2017 Annual Meeting. The Board currently consists of eleventen directors. The Board’s leadership is structured so that there is a separate Chairman of the Board and Chief Executive Officer. The Chairman of the Board is also an independent director. The Board believes that this structure is appropriate for our Company and our shareholders at this time because it provides an additional layer of oversight to management and management’s activities and allows the Board to act independent of management.

Director Qualifications and Biographical Information

The Nominating Committee considered the character, experience, qualifications and skills of each director, including the current director nominees, when determining whether each should serve as a director of the Company. In keeping with its stated criteria for director nominees described in the section entitled

7

“Consideration of Director Nominees” above, the Nominating Committee determined that each director, including the current director nominees, has substantial management experience, exhibits the highest personal values, judgment and integrity, and possesses an understanding of the environment in which the Company does business and diverse experience with the key business, financial and other challenges that the Company faces. Each director is or has been a leader in his respective field and brings diverse talents and perspectives to the Board. The Nominating Committee also considered the experience and qualifications outlined below in the biographical information for each director, including each director nominee, as well as other public company board service.

The Nominating Committee noted the following particular attributes and qualities it considers when evaluating director nominees. The Nominating Committee believes that nominees with business and strategic management experience gained from service as a chief executive officer or similar position is a critical leadership component to Board service. The Nominating Committee also seeks nominees with backgrounds in finance, banking, economics, and the securities and financial markets, in order to have directors who can assess and evaluate the Company’s financial and competitive position. The Nominating Committee emphasizes familiarity with the real estate and agricultural industries, and considers customer perspectives to be important when evaluating director nominees. Although the directors listed below each possess a number of these attributes, the Nominating and Corporate Governance Committee considered the specific areas noted below for each director when determining which of the director’s qualifications best suited the needs of the Company and qualify them to serve as a director of the Company.

The following table sets forth information regarding the nominees for Class III Directors and also regarding the Class IIIII Directors and the Class IIII Directors.

Nominees for Class I Directors Whose Terms Expire in 2015 and Principal Occupation, Employment, or Directorships | First Became Director | Age | ||||||

Anthony L. Leggio | 2012 | 63 | ||||||

Mr. Leggio has been President of Bolthouse Properties, LLC, a commercial and residential real estate development firm, since January 2006. Prior to serving at Bolthouse Properties, LLC, Mr. Leggio served as Vice President and General Counsel of Wm Bolthouse Farms from July 2001 until December 2005. Previously, Mr. Leggio was Managing Partner of the law firm of Clifford and Brown for nearly 25 years. Mr. Leggio has served as a director of Valley Republic Bank since 2008, Three Way Chevrolet Company since 2000, H.F. Cox Trucking since 1993, Mark Christopher Chevrolet since 2001, and W.B. Camp Companies since 2009. Mr. Leggio received his B.S. degree from University of the Pacific and his J.D. from University of the Pacific, McGeorge School of Law. Our Board believes Mr. Leggio’s real estate development and agricultural experience, his tenure as CEO of a real estate development company and his legal experience make him well qualified to serve as a director. | ||||||||

Geoffrey L. Stack | 1998 | 71 | ||||||

Mr. Stack has been the managing director of the Sares-Regis Group, a commercial and residential real estate development and management firm, since 1993. Mr. Stack is responsible for all residential operations of Sares-Regis including development, acquisitions, finance, and management activities. Mr. Stack graduated from Georgetown University and received a M.B.A. in Real Estate Finance at the Wharton School, University of Pennsylvania. Our Board believes Mr. Stack’s real estate development experience and his experience as the managing director of a real estate company make him well qualified to serve as a director. | ||||||||

Class II Directors Whose Terms Expire in 2016 and Principal Occupation, Employment, or Directorships | First Became Director | Age | ||

Robert A. Alter | 2014 | 65 | ||

Mr. Alter is currently President of Seaview Investors, LLC, Newport Beach, CA, and has held that position since 2007. He is the Chairman Emeritus and Founder of Sunstone Hotel Investors (NYSE: SHO), where he served as Chief Executive Officer of the company (or its predecessor) from 1985 to 2007 after which he became Executive Chairman and remained on the board until 2012. He is one of the premier hotel investment and management executives in the hospitality industry. During the 22-year period of Mr. Alter’s position as Chief Executive Officer, Sunstone acquired 125 hotel properties with over 20,000 guest rooms. Mr. Alter received a B.S. in Hotel Administration from Cornell University School of Hotel Administration. Our Board believes that Mr. Alter’s hospitality background makes him very qualified to serve as a director. | ||||

Steven A. Betts * | 2014 | 58 | ||

Mr. Betts is Director of Development for Chanen Development Company, an affiliate of the award-winning, full-service construction organization, Chanen Construction, headquartered in Phoenix and operating throughout the U.S. Mr. Betts served as President of Chanen Development Company from 2014 until 2015, when he was appointed Director of Development. Since 2015 he has also served as Senior Advisor to both the Holualoa Companies, a commercial real estate investment company with three-quarters of a billion dollars in assets held all across the U.S. and in Europe, and beginning in 2016 as Senior Advisor to the Southwest Division of Hines, one of the largest commercial investment and development companies in the world. Mr. Betts also served as the Chief Executive Officer of Phoenix Mart, a 1.7 million square foot multi-category, manufacturing product-sourcing center from June 2013 to October 2013 and as the Senior Vice President and Managing Director of Assets for the ASU Foundation from March 2012 through May 2013. Previous to these endeavors, Mr. Betts was President and Chief Executive Officer of SunCor Development Company from 2005 to 2010, a half-billion dollar plus asset base subsidiary of the publicly traded Pinnacle West Capital Corporation. SunCor was a developer of master planned communities throughout the Mountainwest and large-scale commercial projects in Metropolitan Phoenix. Mr. Betts holds numerous board and committee posts, including Chairman of the Interstate 11 Coalition, Chairman and Trustee of the Arizona Chapter of The Nature Conservancy, and a past-chair and current member of the Urban Land Institute-Arizona District Council Governance Committee. Mr. Betts received his law degree with honors from DePaul University and a B.A. with honors from Augustana College. Our Board believes that Mr. Betts’ master planned community background makes him very qualified to serve as a director.

* As discussed above, Mr. Betts currently serves as a Class III Director, but is being nominated for election as a Class II Director. See “The Election of Directors” for additional information. | ||||

Daniel R. Tisch | 2012 | 65 | ||

Mr. Tisch has been the managing member of TowerView LLC, an investment fund of the Tisch Family, since 2001. Since January 2012, Mr. Tisch has also served as a director of Vornado Realty Trust. Mr. Tisch graduated from Brown University and has over 40 years of investing experience. Mr. Tisch worked for major Wall Street firms from 1973-1989 and since then has been managing investment partnerships. Our Board believes that Mr. Tisch’s investment industry background and his experience in capital raising and risk management make him well qualified to serve as a director. | ||||

Class III Directors Whose Terms Expire in 2017 and Principal Occupation, Employment, or Directorships Gregory S. Bielli Mr. Bielli is President and Chief Executive Officer of Tejon Ranch Co., a position he’s held since December 2013. Prior to this position, Mr. Bielli served as the Chief Operating Officer for the Company from September 2013 through November 2013. Mr. Bielli has nearly 25 years of experience in real estate, land acquisition, development and financing. Prior to Tejon Ranch, he was a regional president of Newland Communities, one of the country’s largest and most successful master planned community developers. Mr. Bielli served as President of Newland’s Western Region from 2006 until September 2013. Mr. Bielli earned a bachelor’s degree in Political Science from the University of Arizona in 1983. Our Board believes Mr. Bielli’s experience in real estate operations, specifically master planned communities and his position as Chief Executive Officer of the Company, make him well qualified to serve as director. John L. Goolsby Mr. Goolsby was employed by the Howard Hughes Corporation from 1980 until his retirement in 1998, serving as President and Chief Executive Officer from 1988 until 1998. Howard Hughes Corporation was a real estate investment and development company that developed numerous large scale real estate projects in Nevada and California, the largest being the Summerlin community in Las Vegas, Nevada. Mr. Goolsby served as a director of Thomas Properties Group Inc. from 2006 until 2013. Mr. Goolsby also formerly served as a director of America West Airlines, Sierra Pacific Corporation and its predecessor, Nevada Power Company, First Interstate Bank of Nevada, Bank of America-Nevada, and as a Trustee of The Donald W. Reynolds Foundation. In 2005, he established the Goolsby Leadership Academy in the College of Business at The University of Texas at Arlington. Mr. Goolsby received a B.B.A. from The University of Texas at Arlington and is a certified public accountant. Our Board believes Mr. Goolsby’s extensive real estate experience and his experience as a chief executive officer of a major real estate land and development company make him well qualified to serve as director. Norman J. Metcalfe Mr. Metcalfe has served as Chairman of the Company’s Board of Directors since 2014. Mr. Metcalfe has an extensive history and background in real estate development and homebuilding. He previously was Vice Chairman and Chief Financial Officer of The Irvine Company, one of the nation’s largest real estate and community development companies. Mr. Metcalfe retired from the Irvine Company in 1998. Prior to the Irvine Company, Mr. Metcalfe spent over 20 years in various real estate, corporate finance and investment positions with the Kaufman and Broad/SunAmerica family of companies. These positions included President and Chief Investment Officer of SunAmerica Investments and Chief Financial Officer of Kaufman and Broad Home Corporation (currently known as KB Homes). Mr. Metcalfe is currently a director of CalAtlantic Homes, having served since 2000. Mr. Metcalfe received a B.S. and an M.B.A. from the University of Washington. Our Board believes Mr. Metcalfe’s extensive financial experience, understanding of capital structure within the real estate industry, and experience in publicly held companies make him very qualified to serve as a director. First

Became

Director Age 2013 55 1999 74 1998 73

Class I Directors Whose Terms Expire in 2018 and Principal Occupation, Employment, or Directorships Anthony L. Leggio Mr. Leggio has been President of Bolthouse Properties, LLC, a commercial and residential real estate development firm, since January 2006. Prior to serving at Bolthouse Properties, LLC, Mr. Leggio served as Vice President and General Counsel of Wm Bolthouse Farms from July 2001 until December 2005. Previously, Mr. Leggio was Managing Partner of the law firm of Clifford and Brown for nearly 25 years. Mr. Leggio has served as a director of Valley Republic Bank since 2008, Three Way Chevrolet Company since 2000, H.F. Cox Trucking since 1993, Mark Christopher Chevrolet since 2001, and W.B. Camp Companies since 2009. Mr. Leggio received his B.S. degree from University of the Pacific and his J.D. from University of the Pacific, McGeorge School of Law. Our Board believes Mr. Leggio’s real estate development and agricultural experience, his tenure as Chief Executive Officer of a real estate development company and his legal experience make him well qualified to serve as a director. Geoffrey L. Stack Mr. Stack has been the managing director of the Sares-Regis Group, a commercial and residential real estate development and management firm, since 1993. Mr. Stack is responsible for all residential operations of Sares-Regis including development, acquisitions, finance, and management activities. Mr. Stack graduated from Georgetown University and received an M.B.A. in Real Estate Finance at the Wharton School, University of Pennsylvania. Our Board believes Mr. Stack’s real estate development experience and his experience as the managing director of a real estate company make him well qualified to serve as a director. Frederick C. Tuomi Mr. Tuomi is currently the Chief Executive Officer of Colony Starwood Homes (SFR), the company formed from the merger of Colony America Homes (CAH) and Starwood Waypoint Residential Trust (SWAY). SFR is a public single family REIT, owning over 30,000 homes in markets across the U.S. Mr. Tuomi served as CAH’s Co-President from March 2015 to January 2016 and COO from July 2013 to January 2016. He was responsible for setting CAH’s strategic direction and leading the operations of CAH’s operations including construction/renovations, marketing, leasing, property management, asset management, human resources and information technology. Mr. Tuomi also served as Executive Vice President and President, Property Management for Equity Residential, a multi-family REIT from January 1994 through June 2013. He led the development of Equity Residential’s Property Management Group through years of rapid growth and expansion to become the nation’s largest apartment REIT. Throughout his 35 year career, he has served on numerous multi-family industry boards and executive committees, including the National Multi-Housing Council, California Housing Council, California Apartment Association and the USC Lusk Center for Real Estate. Mr. Tuomi also serves on the board of directors and as treasurer of the National Rental Housing Council. Mr. Tuomi is a graduate of Georgia State University, with degrees in Business Information Systems and an M.B.A. Our Board believes that Mr. Tuomi’s real estate background and understanding of the single family housing market make him very qualified to serve as a director.8 First

Became

Director Age 2012 64 1998 72 2014 61

Nominees for Class I Directors Whose Terms Expire in 2015 and Principal Occupation, Employment, or Directorships | First Became Director | Age | ||||||

Frederick C. Tuomi | 2014 | 60 | ||||||

Mr. Tuomi has been Chief Operating Officer for Colony American Homes, Inc., Scottsdale, AZ since July of 2013. In that capacity, he is responsible for the company’s operations including construction, renovation, marketing, leasing, property management, asset management, human resources, and information technology. Mr. Tuomi also served as Executive Vice President and President, Property Management for Equity Residential, a multi-family REIT from January 1994 through June 2013. He led the development of Equity Residential’s Property Management Group through years of rapid growth and expansion to become the nation’s largest apartment REIT. Mr. Tuomi received B.A. and M.B.A. degrees from Georgia State University. Our Board believes that Mr. Tuomi’s background and experience make him very qualified to serve as a director. | ||||||||

Michael H. Winer | 2001 | 59 | ||||||

Mr. Winer has been employed by Third Avenue Management LLC (or its predecessor) since May 1994. He is a senior member of the investment team. Mr. Winer has managed the Third Avenue Real Estate Value Fund since its inception in September 1998. Mr. Winer has served as a director of Newhall Holding Company LLC since 2009 and as a director of 26900 Newport Inc. since 1998. He retired as a director of Real Mortgage Systems Inc. in November 2009. Mr. Winer received a B.S. degree in accounting from San Diego State University and was formerly a certified public accountant in California. Our Board believes that Mr. Winer’s investment industry background and specifically his experience with real estate investing make him very qualified to serve as a director on our Board. | ||||||||

Class II Directors Whose Terms Expire in 2016 and Principal Occupation, Employment, or Directorships | First Became Director | Age | ||||||

Robert A. Alter | 2014 | 64 | ||||||

Mr. Alter is currently President of Seaview Investors, LLC, Newport Beach, CA, and has held that position since 2007. He is the Chairman Emeritus and Founder of Sunstone Hotel Investors (NYSE: SHO), where he served as CEO of the company (or its predecessor) from 1985 to 2007 after which he became Executive Chairman and remained on the board until 2012. He is one of the premier hotel investment and management executives in the hospitality industry. During the 22-year period of Mr. Alter’s position as CEO, Sunstone acquired 125 hotel properties with over 20,000 guest rooms. Mr. Alter received a B.S. in Hotel Administration from Cornell University School of Hotel Administration. Our Board believes that Mr. Alter’s hospitality background makes him very qualified to serve as a director. | ||||||||

Robert A. Stine | 1996 | 68 | ||||||

Mr. Stine served as the President and Chief Executive Officer of Tejon Ranch Co. from May 1996 until December 2013. Mr. Stine has served as a director of Pacific Western Bancorp since 1996 and as a director of Valley Republic Bank since 2008. Mr. Stine also formerly served as a director of The Bakersfield Californian from 1999 until 2009. Mr. Stine received a B.S. from St. Lawrence University and a M.B.A. from the Wharton School of Business, University of Pennsylvania. Our Board believes Mr. Stine’s extensive real estate development background and his strategic and operational insight from managing the Company make him well qualified to serve as a director. | ||||||||

9

Class II Directors Whose Terms Expire in 2016 and Principal Occupation, Employment, or Directorships | First Became Director | Age | ||||||

Daniel R. Tisch | 2012 | 64 | ||||||

Mr. Tisch has been the managing member of TowerView LLC, an investment fund of the Tisch Family, since 2001. Since January 2012, Mr. Tisch has also served as a director of Vornado Realty Trust. Mr. Tisch graduated from Brown University and has over 39 years of investing experience. Mr. Tisch worked for major Wall Street firms from 1973-1989 and since then has been managing investment partnerships. Our Board believes that Mr. Tisch’s investment industry background and his experience in capital raising and risk management make him well qualified to serve as a director. | ||||||||

Class III Directors Whose Terms Expire in 2017 and Principal Occupation, Employment, or Directorships | First Became Director | Age | ||||||

Steven A. Betts | 2014 | 57 | ||||||

Mr. Betts is President for Chanen Development Company, an affiliate of the award-winning, full-service construction organization, Chanen Construction, headquartered in Phoenix and operating throughout the U.S. He has served as President since November 2014. He also served as the Chief Executive Officer of PhoenixMart, a 1.7 million square foot multi-category, manufacturer product-sourcing center from June 2013 to October 2013 and served as the Senior Vice President and Managing Director of Assets for the ASU Foundation from March 2012 through May 2013. Previous to these endeavors, Mr. Betts was President and CEO of SunCor Development Company from 2005 to 2010, a half-billion dollar plus asset base subsidiary of the publicly traded Pinnacle West Capital Corporation. SunCor is a developer of master planned communities throughout the Mountainwest and large-scale commercial projects in Metropolitan Phoenix. Mr. Betts holds numerous board and committee posts, including Chairman of the Interstate 11 Coalition, and Chairman of the Urban Land Institute-Arizona District Council Governance Committee. Mr. Betts received his law degree with honors from DePaul University and a B.A. with honors from Augustana College. Our Board believes that Mr. Betts’ master planned community background makes him very qualified to serve as a director. | ||||||||

Gregory S. Bielli | 2013 | 54 | ||||||

Mr. Bielli has served as President and Chief Executive Officer of Tejon Ranch since December 2013. Prior to this position, Mr. Bielli served as the Chief Operating Officer for the Company since September 2013. Mr. Bielli has nearly 25 years experience in real estate, land acquisition, development and financing. He comes to Tejon Ranch most recently from Newland Communities, one of the country’s largest and most successful master planned community developers. Mr. Bielli served as President of Newland’s Western Region from 2006 until September 2013. Mr. Bielli earned a bachelor’s degree in Political Science from the University of Arizona in 1983. Our Board believes Mr. Bielli’s experience in real estate operations, specifically master planned communities and his position as CEO of the Company, make him well qualified to serve as director. | ||||||||

10

Class III Directors Whose Terms Expire in 2017 and Principal Occupation, Employment, or Directorships | First Became Director | Age | ||||||

John L. Goolsby | 1999 | 73 | ||||||

Mr. Goolsby served as President and Chief Executive Officer of the Howard Hughes Corporation from 1988 until his retirement in 1998. Howard Hughes Corporation is a real estate investment and development company that successfully developed several large-scale real estate projects in Nevada and California, the largest being the Summerlin community in Las Vegas, Nevada. Mr. Goolsby served as a director of Thomas Properties Group Inc. from 2006 until 2013. Mr. Goolsby formerly served as a director of America West Airlines from 1994 until 2005 and Sierra Pacific Corporation and its predecessor, Nevada Power Company, from 1989 until 2001. He served as a Trustee of The Donald W. Reynolds Foundation from 1994 until 2005. Mr. Goolsby received a B.B.A. from the University of Texas at Arlington and is a certified public accountant. Our Board believes Mr. Goolsby’s extensive real estate experience and his experience as a chief executive officer of a major real estate land and development company make him well qualified to serve as director. | ||||||||

Norman J. Metcalfe | 1998 | 72 | ||||||

Mr. Metcalfe has an extensive history and background in real estate development and homebuilding. He previously was Vice Chairman and Chief Financial Officer of The Irvine Company, one of the nation’s largest real estate and community development companies. Mr. Metcalfe retired from the Irvine Company in 1998. Prior to the Irvine Company, Mr. Metcalfe spent over 20 years in various real estate, corporate finance and investment positions with the Kaufman and Broad/SunAmerica family of companies. These positions included President and Chief Investment Officer of SunAmerica Investments and Chief Financial Officer of Kaufman and Broad Home Corporation (currently known as KB Homes). Mr. Metcalfe is currently a director of The Ryland Group, having served since 2000, and previously served as a director of Building Materials Holding Corp from 2005 until 2009. Mr. Metcalfe received a B.S. and a M.B.A. from the University of Washington. Our Board believes Mr. Metcalfe’s extensive financial experience, understanding of capital structure within the real estate industry, and experience in publicly held companies make him very qualified to serve as a director. | ||||||||

Class I Directors Whose Terms Expire in 2018 and Principal Occupation, Employment, or Directorships | First Became Director | Age | ||

Michael H. Winer | 2001 | 60 | ||

Mr. Winer has been employed by Third Avenue Management LLC (or its predecessor) since May 1994. He is a senior member of the investment team. Mr. Winer has managed the Third Avenue Real Estate Value Fund since its inception in September 1998. Mr. Winer has served as a director of Newhall Holding Company LLC since 2009 and as a director of 26900 Newport Inc. since 1998. He retired as a director of Real Mortgage Systems Inc. in November 2009. Mr. Winer received a B.S. degree in accounting from San Diego State University and was formerly a certified public accountant in California. Our Board believes that Mr. Winer’s investment industry background and specifically his experience with real estate investing make him very qualified to serve as a director on our Board. | ||||

None of the corporations or organizations described above are subsidiaries, or other affiliates of the Company. There are no family relationships among any directors or executive officers of the Company.

Corporate Governance MattersCORPORATE GOVERNANCE MATTERS

The Board has determined that all directors, except Mr. Bielli and Mr. Stine,, are “independent” under the listing standards of the New York Stock Exchange (the “NYSE”) and the Company’s categorical criteria used to determine whether a director is independent (the “Independence Standards”). In addition, the Board determined that former director Robert A. Stine, who resigned on May 15, 2015, was not independent. The Independence Standards are set forth in Attachment A to the Company’s Corporate Governance Guidelines (the “Corporate Governance Guidelines”), and a copy of the Independence Standards is attached as Appendix A to this Proxy Statement. Thus, the Board determined that the following directors are independent: Robert A. Alter, Steven A. Betts, John L. Goolsby, Anthony L. Leggio, Norman J. Metcalfe, Geoffrey L. Stack, Daniel R. Tisch, Frederick C. Tuomi, and Michael H. Winer.

Also, in making its independence determinations, the Board reviewed additional information provided by the directors and the Company with regard to any business or personal activities or associations as they may relate to the Company and the Company’s management. The Board considered this information in the context of the NYSE’s objective listing standards, the Independence Standards, and for directors serving on committees, the

11

additional standards established for members of audit committees and compensation committees. In reaching a determination on these directors’ independence, the Board considered that neither the directors nor their immediate family members have within the past three years had any direct or indirect business or professional relationships with the Company other than in their capacity as directors.

The Board’s independence determinations included a review of business dealings at companies where the directors serve as directors or outside consultants, all of which were ordinary course business transactions. The Board also performs a review of the Company’s charitable contributions to any organization where a director serves as an executive officer and found no contributions in excess of the Independence Standards.

The independent directors of the Board meet regularly in executive sessions outside the presence of management. As Chairman of the Board, Mr. Metcalfe presides over these executive sessions.

During 2014,2015, there were sixfour meetings of the Board. During 20142015 all directors attended 75% or more of the aggregate total of such meetings of the Board and committees of the Board on which they served.

The Company’s policy is that all directors are expected to attend every annual stockholders meeting in person. All directors attended the 20142015 Annual Meeting of the Company.

Committees of the Board

Standing committees of the Board include the Executive, Audit, Compensation, Investment Policy, Real Estate, and Nominating and Corporate Governance Committees. The current members of the standing committees are set forth below:

| Executive Committee | Audit Committee | Compensation Committee | Real Estate Committee | Nominating and Corporate Governance Committee | Investment Policy Committee | |||||||

Robert A. Alter | X | X | ||||||||||

Steven A. Betts | X (Chair) | X | ||||||||||

Gregory S. Bielli | X | |||||||||||

John L. Goolsby | X | X (Chair) | ||||||||||

Anthony L. Leggio | X (Chair) | X | ||||||||||

Norman J. Metcalfe | X (Chair) | X | X | X | X | |||||||

Geoffrey L. Stack | X | X | X | |||||||||

| ||||||||||||

Daniel R. Tisch | X | X | X | |||||||||

Frederick C. Tuomi | X | X | ||||||||||

Michael H. Winer | X | X | X (Chair) | X |

During 2014,2015, there were notwo meetings of the Executive Committee, seven of the Audit Committee, twoseven of the Compensation Committee, twofour of the Real Estate Committee, onetwo of the Nominating Committee, and no meetings of the Investment Policy Committee. The major functions of each of these committees, including their role in oversight of risks that could affect the Company, are described briefly below.

The Executive Committee

Except for certain powers that, under Delaware law, may be exercised only by the full Board, or which, under the rules of the Securities and Exchange Commission (the “SEC”) or the NYSE, may only be exercised by committees composed solely of independent directors, the Executive Committee may exercise all powers and authority of the Board in the management of the business and affairs of the Company.

12

The Audit Committee

The Audit Committee represents and assists the Board in fulfilling the Board’s oversight responsibility relating to (i) the accounting, reporting, and financial practices of the Company and its subsidiaries, including the integrity of the Company’s financial statements; (ii) the surveillance of administration and financial controls and the Company’s compliance with legal and regulatory requirements; (iii) the independent auditor’s qualifications and independence; and (iv) the performance of the company’s internal audit function and the Company’s independent auditor. In addition, the Audit Committee is directly responsible for the retention of the independent auditor and approves all audit and non-audit services the independent auditor performs. It also reviews and discusses the Company’s policies with respect to risk assessment and risk management. The Audit Committee reports regularly to the full Board with respect to its activities. The Audit Committee is governed by a written charter adopted and approved by the Board. The Audit Committee’s charter is available on the Company’s web site,www.tejonranch.com, in the Corporate Governance section of the Investor Relations webpage, and is available in print form upon request to the Corporate Secretary, P.O. Box 1000, Tejon Ranch, California 93243.

The Board has determined that each member of the Audit Committee is independent under the listing standards of the NYSE and under the Company’s Independence Standards, and that each member of the Audit Committee is financially literate and meets the requirements for Audit Committee Membership set forth in Rule 10A-3 of the Exchange Act. The Board has further found that Mr. Leggio qualifies as an “audit committee financial expert” for the purposes of Item 407(d)(5) of Regulation S-K, and has “accounting or related financial management expertise” as described in the listing standards of the NYSE.

The Compensation Committee

The Compensation Committee oversees the Company’s overall compensation structure, policies and programs, and it assesses whether the Company’s compensation structure establishes appropriate incentives for management and employees. It also reviews and approves corporate goals and objectives relevant to the compensation of top managerial and executive officers, evaluates their performance in light of those goals and objectives, and makes recommendations regarding their compensation. It administers and makes recommendations to the Board with respect to the Company’s incentive compensation and equity-based compensation plans and grants of awards thereunder. It also reviews and recommends to the Board the design of other benefit plans, employment agreements, and severance arrangements for top managerial and executive officers. The Compensation Committee oversees the assessment of the risks related to the Company’s compensation policies and programs applicable to officers and employees, reviews the results of this assessment, and also assesses the results of the Company’s most recent advisory vote on executive compensation. It approves, amends or modifies the terms of any compensation or benefit plan that does not require shareholder approval, if delegated to the Committee by the Board. It reviews and recommends changes for the compensation of directors, and it reviews succession plans relating to positions held by senior executive officers. It reports regularly to the Board with respect to its activities.

The Compensation Committee is governed by a written charter adopted and approved by the Board. The Compensation Committee’s charter is available on the Company’s web site,www.tejonranch.com, in the Corporate Governance section of the Investor Relations webpage, and is available in print form upon request to the Corporate Secretary, P.O. Box 1000, Tejon Ranch, California 93243. The Compensation Committee is authorized to delegate to a subcommittee consisting of not less than two members of the Compensation Committee the responsibility to review specific issues, meet with management on behalf of the committee regarding such issues, and prepare recommendations or reports or review by the committee. The Board has determined that each member of the Compensation Committee is independent under the listing standards of the NYSE for directors and compensation committee members and under the Company’s Independence Standards.

The CEO does not participate in the Compensation Committee’s deliberations with regard to his own compensation. At the Compensation Committee’s request, the CEO reviews with the Compensation Committee the performance of the other executive officers, but no other executive officers have any input in executive

13

compensation decisions. The Compensation Committee gives substantial weight to the CEO’s evaluations and recommendations because he is particularly able to assess the other executive officers’ performance and contributions to the Company.

During 2013,2015, the Compensation Committee engaged Poe Consulting to assist in the review of executive officer compensation.the CEO’s, compensation and identification of Peer Group companies. The decision to engage an outside compensation consultant was not recommended by management. Poe Consulting completed its 2013 engagement during March of 2014,was used throughout 2015 and its feesservices were $55,000.used in helping to determine 2016 salary adjustments. Poe Consulting did not provide any other services to the Company in 2014.2015 and its fees were $51,191 for the year. The Compensation Committee has reviewed an assessment of any potential conflicts of interest raised by Poe Consulting’s work for the Compensation Committee, which assessment considered the following six factors: (i) the provision of other services to the Company by Poe Consulting; (ii) the amount of fees received from the Company by Poe Consulting, as a percentage of Poe Consulting’s total revenue; (iii) the policies and procedures of Poe Consulting that are designed to prevent conflicts of interest; (iv) any business or personal relationship of the Poe Consulting consultant with a member of the Compensation Committee; (v) any Company stock owned by the Poe Consulting consultants; and (vi) any business or personal relationship of the Poe Consulting consultant or Poe Consulting with any of the Company’s executive officers, and concluded that there are no such conflicts of interest.

The Real Estate Committee

The Real Estate Committee provides oversight, guidance and strategic input into management action plans for development and entitlement of Company land, and it provides a review function to management regarding major decision points within the Company’s development projects. It reviews and either approves or recommends to the Board appropriate action on significant proposed real estate transactions and development pro formas and budgets. The Real Estate Committee also provides oversight and guidance to the Company’s Chief Executive Officer with regard to recruitment and employment of senior real estate executives. It reports regularly to the full Board with respect to its meetings. The Real Estate Committee’s charter is available on the Company’s web site,www.tejonranch.com, in the Corporate Governance section of the Investor Relations webpage, and is available in print form upon request to the Corporate Secretary, P.O. Box 1000, Tejon Ranch, California 93243.

Investment Policy Committee

The Investment Policy Committee reviews policies and activities related to the investment of the Company’s cash assets and works in coordination with the Real Estate Committee. It receives and reviews policy and data regarding marketable security investments and recommends approval of the Company’s investment security policy to the Board.

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee (“Nominating Committee”) is charged with assessing existing directors to determine whether to recommend them for reelection to the Board, identifying and recruiting potential new directors, establishing a procedure for consideration of candidates for director positions recommended by stockholders, and recommending candidates to be nominated by the Board or elected by the Board as necessary to fill vacancies and newly created directorships. It also reviews and makes recommendations to the Board respecting the structure, composition and functioning of the Board and its committees, and it evaluates the Corporate Governance Guidelines and the Board’s performance.

The Board has determined that each member of the Nominating Committee is independent under the listing standards of the NYSE and under the Company’s Independence Standards. The Nominating Committee is governed by a written charter adopted and approved by the Board. The Nominating Committee’s charter is available on the Company’s web site,www.tejonranch.com, in the Corporate Governance section of the Investor Relations webpage, and is available in print form upon request to the Corporate Secretary, P.O. Box 1000, Tejon Ranch, California 93243.

The Nominating Committee is pleased to consider any properly submitted recommendations of director candidates from stockholders. Stockholders may recommend a candidate for consideration by the Nominating Committee by sending written notice addressed to the Nominating and Corporate Governance Committee Chair,

14

c/o Corporate Secretary, P.O. Box 1000, Tejon Ranch, California 93243. The Nominating Committee does not evaluate candidates differently based on who has made the recommendation. Stockholders may also nominate persons for election to the Board by providing timely notice in writing to the Secretary of the Company pursuant to the procedures set forth in the Company’s Certificate of Incorporation. See “Stockholder Proposals for 20162017 Annual Meeting” for additional information on the procedure for stockholder nominations.

The Nominating Committee has the authority under its charter to hire and pay a fee to outside counsel, experts or other advisors to assist in the process of identifying and evaluating candidates. No such outside advisors have beenwere used to dateduring 2015 and, accordingly, no fees have beenwere paid to such advisors during 2015. Past practice has been for the Nominating Committee to seek recommendations for new directors from current directors, the Chief Executive Officer, and outside advisors.

Code of Business Conduct and Ethics and Corporate Governance Guidelines

CODE OF BUSINESS CONDUCT AND ETHICS AND CORPORATE GOVERNANCE GUIDELINES

The Board has adopted a Code of Business Conduct and Ethics, which is applicable to all directors, officers and employees. It also has adopted Corporate Governance Guidelines to guide its own operations. Both documents (including Attachment A to the Corporate Governance Guidelines, which constitutes the Company’s Independence Standards) are available on the CompanyCompany’s web site,www.tejonranch.com, in the Corporate Governance section of the Investor Relations webpage, and are available in print form upon request to the Corporate Secretary, P.O. Box 1000, Tejon Ranch, California 93243.

Succession PlanningSUCCESSION PLANNING

The Board, with the assistance of the Compensation Committee, oversees succession plans for the Chief Executive Officer and other senior executive officers. These plans relate both to succession in emergency situations and longer-term succession. As set forth in the Corporate Governance Guidelines and Compensation Committee Charter, the Compensation Committee reviews the Company’s succession planning for senior executive officers at least annually. The Chief Executive Officer also provides the Board with input regarding these matters.

Board’s Role in Risk OversightBOARD’S ROLE IN RISK OVERSIGHT

The full Board oversees the Company’s risk management process. The Board oversees a Company-wide approach to risk management, designed to enhance stockholder value, support the achievement of strategic objectives and improve long-term organizational performance. The full Board determines the appropriate level of risk for the Company generally, assesses the specific risks faced by the Company and reviews the steps taken by management to manage those risks. The full Board’s involvement in setting the Company’s business strategy facilitates these assessments and reviews, culminating in the development of a strategic plan that reflects both the Board’s and management’s consensus as to appropriate levels of risk and the appropriate measures to manage those risks. The full Board assesses risk throughout the enterprise, focusing on risks arising out of various aspects of the Company’s strategic plan and the implementation of that plan, including financial, legal/compliance, operational/strategic and compensation risks. In addition to discussing risk with the full Board, the independent directors discuss risk management during executive sessions without management present.

While the full Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk in certain specified areas. In particular, the Audit Committee focuses on financial risk, including internal controls, and discusses the Company’s risk profile with the Company’s internal auditors. The Audit Committee also reviews potential violations of the Company’s Code of Ethics and related corporate policies. The Compensation Committee periodically reviews compensation practices and policies to determine whether they encourage excessive risk taking. Finally, the Nominating Committee manages risks associated with the independence of directors and Board nominees. Pursuant to the Board’s instruction, management regularly reports on applicable risks to the relevant committee or the full Board, as appropriate, with additional review or reporting on risks being conducted as needed or as requested by the Board and its committees.

The Compensation Committee has also reviewed the design and operation of the Company’s compensation structures and policies as they pertain to risk and has determined that the Company’s compensation programs do not create or encourage the taking of risks that are reasonably likely to have a material adverse effect on the Company.

15

COMPENSATION DISCUSSION &AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) describes our compensation program for the following individuals, all of whom are considered NEOs for 2015.

| Name | Title | |

| Gregory S. Bielli | Chief Executive Officer | |

| Allen E. Lyda | Chief Financial Officer | |

| Joseph N. Rentfro | Executive Vice President, Real Estate | |

| Hugh F. McMahon | Executive Vice President, Commercial/Industrial Development | |

| Dennis J. Atkinson | Senior Vice President, Agriculture and Water |

This CD&A describes the components of our executive compensation program, providing a discussion of our executive compensation philosophy, policies, and practices. It also describes how and why the Compensation Committee of the Board of Directors arrived at specific 2015 executive compensation decisions and the factors the Compensation Committee considered in making those decisions.

Executive Summary

Our executive compensation program aligns with our strong pay-for-performance philosophy and ties a substantial portion of executive compensation to the achievement of annual and long-term strategic objectives directly tied to the creation of stockholder value. The following is a discussionobjectives of our executive compensation philosophy,program are to (i) drive performance against critical strategic goals designed to create long-term stockholder value and (ii) pay our executives at a level and in a manner that ensures Tejon Ranch is capable of attracting, motivating, and retaining top executive talent.

Our primary business objective is to maximize long-term shareholder value through the monetization of our land-based assets. This is accomplished by moving our assets up the value creation chain through the entitlement process, the mapping process, and components,ultimately to development. A key element of our strategy is to provide entitled land for large scale residential and compensation decisions made with respectmixed use real state communities to serve the following NEOs as listedgrowing population of Southern and Central California. We are currently engaged in commercial sales and leasing at our fully operational commercial/industrial center, and are in the 2014 Summary Compensation Table:mapping process and entitlement process for our three major residential projects. All of these efforts are supported by diverse revenue streams generated from other operations, including farming, mineral resources, and our various joint ventures.

Company Performance - 2015

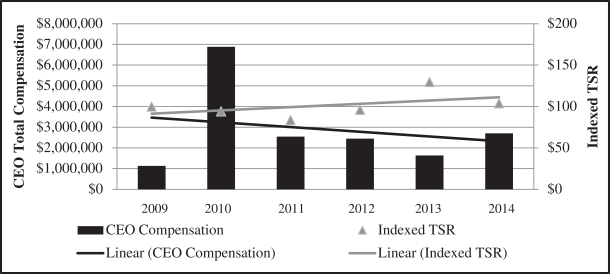

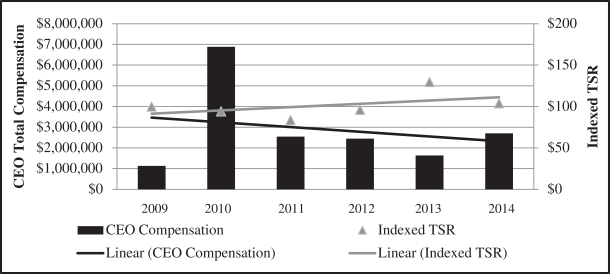

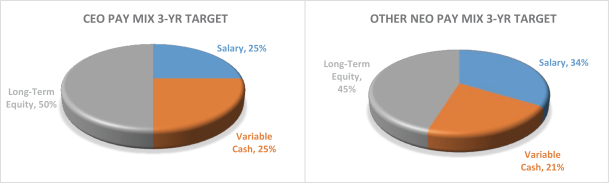

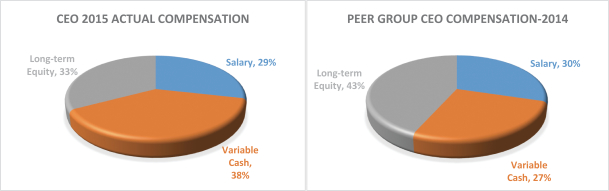

Executive Summary

Our Compensation Committee has developed and maintains a compensation program that is intended to reward performance, retain talent, and encourage actions that drive achievementIncrease in wine grape revenue of our business strategies.